How Much To Pay a House Sitter: Average Rates 2024 UrbanSitter

Table Of Content

In September, the government brought to an end the temporary Stamp Duty Land Tax holiday in England and Northern Ireland that had been in place since July 2020. The measures incentivised buyers as they looked for properties with greater indoor and outdoor space on the back of the coronavirus pandemic. Monthly growth was recorded at 0.7%, taking seasonality into account, compared to 0.2% in September. The Bank of England said today that its Bank base rate will remain at 0.1% at least until 16 December, when the next announcement is due.

May: First-Time Buyers Struggling To Raise Deposits

The average time to sell is also at its slowest since 2015 (excluding the initial months of the pandemic lockdown). Prices rose 0.5% in Scotland this month (average asking price is now at £190,067). But prices in the country have increased the most of any region annually at a rate of 4.2%. The average price of newly-marketed properties increased by 1.5% this month – £5,279 in cash terms – to reach £368,118, according to online property portal Rightmove, writes Jo Thornhill. While prices were down by 0.2% in March itself, prices are higher than a year ago, showing a modest recovery for the market.

October: Weak Market Triggers Steep Price Fall – Nationwide

In terms of regional performance, the south west of England recorded the strongest annual house price growth with a figure of 12.9%. London recorded the lowest figure with average prices up 5.1% in the year to November 2021. The lowest annual house price growth was seen in London, where average prices increased by 8.2% over the 12 months to May. However, average prices in the capital still stood north of half a million pounds in May at £526,000. “The economy has proven to be resilient, with a robust labour market and consumer price inflation predicted to decelerate sharply in the coming months.

How Much Should You Tip a House Sitter?

House prices across the country fell by 0.4% in April, according to the latest data from Nationwide building society, on the heels of a 0.2% fall recorded in March, writes Jo Thornhill. Yes, rates may differ significantly based on the cost of living in different regions. Yes, experienced house sitters may command higher rates due to their proven reliability and skill set. The calculator then considers factors such as market rates and responsibilities to generate a fair compensation figure. This ensures a mutually beneficial arrangement, making the process smoother for both parties involved.

March: MPs To Scrutinise Property Sales Process

Today, it is sitting at a slightly more palatable 6.02%, while an average five-year fixed rate is 5.63%. But these rates are still more than double the level many borrowers have become accustomed to in recent years – a situation that constrains how much people can borrow when they buy a house. More thorough and tighter mortgage affordability testing, introduced in 2015, was designed by the regulator, the Financial Conduct Authority, to prevent households taking on excessive debt at a time of low mortgage rates. Borrowers applying for a new mortgage would have a payment stress test with rates at 6% and 7% for example, even when fixed mortgage rates were under 2%. Prices in London fell the least across southern England, with a 2.4% annual decline. Rightmove also says the number of buyers contacting estate agents about homes for sale was 17% higher than last Boxing Day and visits to its online platform were 8% higher than on the same day last year.

How Much To Pay A House Sitter (4 Factors to Consider)

“Pricing is higher than borrowers have grown used to over the years, meaning those buyers relying on mortgages are more price-sensitive on the back of ongoing affordability concerns. That said, estate agents report a more subdued market, and welcomed the first rise in the cost of a typical UK home seen since March. But despite falls in prices, Righmove says key indicators point to better market activity than predicted in 2023. Vendors are accepting 5.5% off the asking price, on average, to agree a sale, which equates to £18,000 in cash terms. London prices are down marginally year on year by 0.1%, with a 0.9% drop in December.

April: Headline Figures Masks Regional Variations

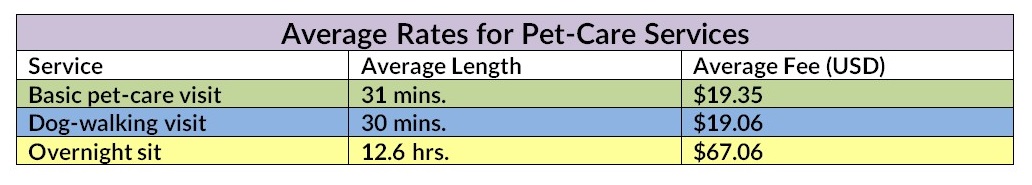

Pet sitting holiday rates: How much you can expect to pay - Care.com

Pet sitting holiday rates: How much you can expect to pay.

Posted: Mon, 26 Sep 2022 07:00:00 GMT [source]

He said these factors are boosting choice for buyers as well as supporting the higher number of sales. Buyers and sellers are also becoming more aligned on pricing, reducing the downward pressure on values. First-time buyers continue to look for opportunities to get onto the property ladder. Zoopla’s latest research shows that 40% of people looking to buy a home in the next two years are first-time buyers. Regionally the outlook is also more positive with just three areas seeing an average fall in asking prices in January (Scotland, Yorkshire and Humber, and London), out of the 11 regions listed by Rightmove. Higher repayments will ensure buyers remain price sensitive and focused on value for money.

How Much Does Dog Sitting & Dog Boarding Cost in the UK? 2024 Update – Dogster - Dogster.com

How Much Does Dog Sitting & Dog Boarding Cost in the UK? 2024 Update – Dogster.

Posted: Mon, 18 Mar 2024 19:59:42 GMT [source]

July: ONS Records Slump In Rate Of House Price Growth

The bank said it expects prices will drop 4.7% this year and by a further 2.4% in 2024 before recovering. It believes long-term growth in the market will remain steady, and has predicted prices will rise by 0.6% by 2027. NIESR is forecasting that house prices will fall by around 6.5% between now and the second quarter of 2025, which would take 50,000 additional households into negative equity, with the West Midlands and Wales worst affected. “Despite a 15-year high in Bank Rate and continuing inflation, buyers are showing there is little chance of a correction, although sales are taking longer and prices are softening. “Mortgage rates have eased from their July high when the average two-year fixed rate climbed to 6.86%, according to Moneyfacts.

More From the Los Angeles Times

However, the capital’s average house price remains the most expensive of any region in the UK at £507,000. Despite the annual gain, Zoopla’s price index shows a 1.3% fall in house prices over the past six months as mortgage rates and living costs have continued to bite. However, house prices have proven more resilient than expected this year overall, despite higher mortgage rates suppressing market activity. While property prices are now around £14,000 below the August 2022 peak, they are 1% above the level seen in December 2021, the month when the Bank of England first increased interest rates from 0.1% to 0.25%. “While house prices have increased on average, the industry is starting to see a slow-down in the rate at which property value is appreciating. With the stamp duty deadline coming to a complete close in the nearing weeks, it is likely that house price growth will start to cool off slightly,” Robinson added.

The rise meant that average property prices were £24,500 higher at the end of 2021 compared with a year earlier. This contributed to a 7.6% rise in the overall annual growth rate for average house prices to January. Rightmove said the last time this figure was exceeded was when it reached 8.3% in May 2016.

Lenders have also withdrawn thousands of home loan deals in the fall out of the Government’s recent mini-budget. Having lagged behind in recent years, the biggest monthly rise at 1.9% was in London where average asking prices stand at £695,642. With a figure of 14.6%, Wales recorded the highest growth in the year to August, followed by England (14.3%), Scotland (9.7%) and Northern Ireland (9.6%).

According to the Nationwide’s House Price Index (HPI), annual house price growth fell back to 10% this month, down from 11% in August. The lender said the average home is now valued at £248,742, about 13% higher than before the pandemic began in early 2020. At country level, the ONS said Scotland, at 16.9%, recorded the largest annual house price growth in the year to August 2021. It says house prices are now almost 15% above the level prevailing in March last year, when the pandemic struck the UK and the housing market was locked down for two months.

According to the Office for National Statistics (ONS), a 10% deposit on a typical first-time buyer home represents 60% of the buyer’s gross annual income, so this difficulty is unsurprising. “Anyone paying their lender’s standard variable rate (SVR), or on any mortgage deal that’s linked to the Bank rate, will have to absorb an almost immediate impact in the cost of their monthly payments. The average time a three-bedroom property is taking to sell increased to 18 days in April, up from 16 days in March.

Annual house price growth has continued to slow and was recorded at just 1.2% for the year to May, according to the latest data from online property portal Zoopla, writes Jo Thornhill. The average house price edged down in June by around £300 compared to May – a 0.1% fall – as higher mortgage costs started to bite. A typical property in the UK now costs £285,932, according to Halifax’s reckoning. Zoopla says 80% of markets with average property prices above £300,000 saw prices decrease year on year in June.

Price falls appear to be mainly concentrated in the south of England, where the impact of higher mortgage rates on pricing has been greater due to higher average property prices. In Scotland, where prices are 40% below the UK national average, annual house price growth is running at 1.6%. It is the 10th consecutive monthly fall in house price inflation, as higher mortgage rates and the cost of living continue to put downward pressure on the housing market. Data from the property portal showed that average house prices in April hit £250,200, marking an annual inflation rate of 8.4% compared to 9% in March.

Comments

Post a Comment